What is the Climate Action Incentive Payment: Your FAQ’s Answered

Through the Canada Carbon Rebate, the federal government returns around 90% of the money it collects to Canadian families each year. In 2024, Albertans will receive higher rebate payments than any other province — on average, a family of four in Alberta will receive over $1,500.

Photo credit: Alexander Dummer/ UNSPLASH

What is the Climate Action Incentive Payment?

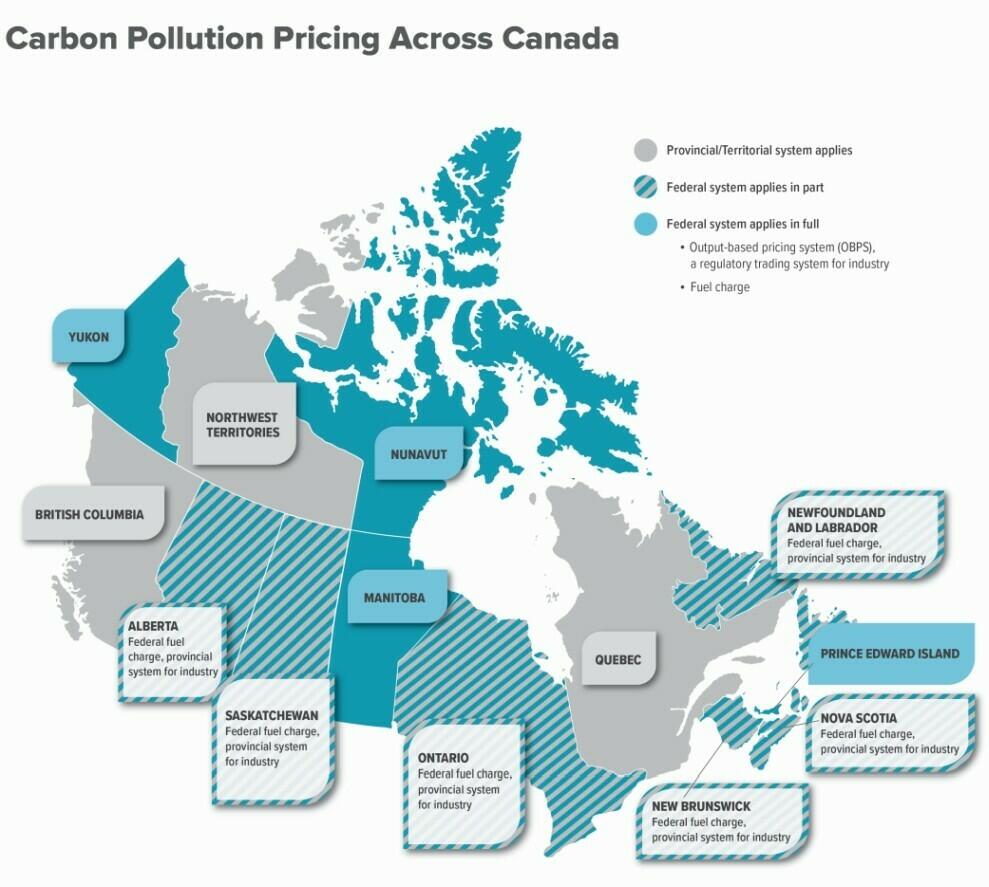

The Climate Action Incentive Payment (CAIP) – now called the Canada Carbon Rebate- is a tax-free benefit paid quarterly to eligible Canadians by the federal government to offset the cost of federal pollution pricing. Since 2019, every jurisdiction in Canada has had a price on carbon pollution — this is what’s called “carbon pricing” or “the carbon tax”. Provinces and territories can design a pricing system that meets their own local needs or choose to use the federal pricing system. British Columbia, the Northwest Territories, and Quebec have their own systems. Every other province or territory uses the federal system in part or in full.

In regions where the federal carbon pricing system applies, the Government of Canada returns the majority of proceeds from the federal fuel charge directly to Canadians through the Canada Carbon Rebate (CCR). The rest of the money goes to groups that may be disproportionately affected by climate change, such as farmers, Indigenous people, and small- and medium-sized businesses. Eight out of ten families receive more in rebates than they pay in levies. In 2024, Albertans will receive higher rebate payments than any other province — on average, a family of four in Alberta will receive over $1,500.

Calgary, AB – Canada’s Carbon Pollution Pricing program benefits individuals and businesses alike. In 2024, the Government of Canada introduced the Canada Carbon Rebate for Small Businesses, which will directly refund over $2.5 billion to eligible businesses in Alberta.

Photo credit: Bill Longstaff /FLICKR

What is carbon pricing?

Carbon pricing is a “polluter pays” system that is designed to act as an incentive for businesses and people to transition to cleaner energy sources. Scientists say that human activities like burning fossil fuels are making climate change worse, which is why carbon pricing is important to help reduce pollution.

Research suggests that carbon pricing will reduce Canada’s emissions by a third by 2030. Carbon pricing also acts as a source of revenue, which aims to fund innovation in alternative, clean energy technologies.

The system lays out the cost of carbon upfront, ensuring industrial polluters understand exactly how much carbon they produce and how much they will pay for their emissions. It allows communities to hold polluters responsible for the environmental and social costs of carbon pollution — including warmer temperatures, polluted air and water, and increases in dangerous weather events.

How does Canada’s Carbon Pollution Pricing work?

Canada’s Carbon Pollution Pricing has slowly increased each year since 2019, from $20 per tonne to today’s price of $80 per tonne. By 2030, the price will rise to $170 per tonne. The current rate only adds about three cents to the cost of a liter of gasoline, and raises inflation by 0.15%. So, while this cost does make things slightly more expensive, the effect on overall prices in the economy is really small.

The carbon pricing system has two parts:

- The first is the fuel charge. This is a regulatory charge consumers pay on fossil fuel products like gasoline and natural gas.

- The second is a performance-based system for industries; this is called the Output-based Pricing System.

Alberta has its own industrial pricing system: the Technology Innovation and Emissions Reduction Regulation (TIER) program. In fact, industrial carbon pricing is not new in Alberta — the province was the first jurisdiction in North America to implement a carbon pricing system for large polluters with the Specified Gas Emitters Regulation (SGER) in 2007. Industrial carbon pricing in Alberta evolved over the years to become more rigorous, until the TIER program took effect in 2020. This program meets the federal benchmark for industrial carbon pollution pricing. However, unlike British Columbia and Quebec, Alberta does not have a carbon pricing system aimed at consumers, so the federal fuel charge applies.

Carbon pollution pricing across Canada. Alberta pays a federal fuel charge but has its own provincial carbon pollution pricing system for industry.

Photo credit: Government of Canada

Where can I learn more?

If you are interested in learning more about climate impacts and solutions relevant to Albertans, check out the Preparing Albertans for Climate Change e-course. This free resource provides insights on the policies that are driving climate action, examples of local projects and initiatives helping to create a more climate-resilient Alberta, and tangible actions individuals can take in day-to-day life.